Mapquest + Mapbox: A Win-Win With A Huge Unanswered Question

by Brian Timoney

In a rare confluence of a languid blogging pace with the tempo of events, my last post on the Verizon purchase of Mapquest was quickly followed by news that Mapquest would be contracting out its map rendering to the high profile start-up Mapbox. No real follow-up has come out of either camp, including silence from the otherwise prolific Mapbox blog. But as nature abhors a vacuum, I’ve independently verified the broad strokes of the deal so will happily offer my speculations in the absence of mere facts.

Here’s what each side wins:

Mapquest gets to move fast on a more mobile-centric strategy on the back of the recently launched Mapbox Mobile SDK. Ditto for being to tap into Mapbox’s work with OpenGL, streaming vectors, and integrating cloud-based DevOps with map usage analytics. And, presumably, an overdue refresh of the Mapquest cartographic style.

But this isn’t a wholesale hollowing out of a brand: Mapquest is keeping its Routing capability in house. Especially in the context of an economy that’s increasingly reliant on-demand logistics, routing is now “hot” again as the ability to adjust routes on-the-fly to real time dynamic conditions is now a competitive necessity for the enterprise.

And should you still be dismissive of Mapquest’s prospects, you can always browse their patent portfolio which makes for interesting reading.

In short: Verizon muscle + Mapbox sexy are a promising combination for a Mapquest resurgence.

Mapbox gets its wares in front of Mapquest’s 40 million unique monthly visitors and an important validation of its vision of being “the map layer for the Internet”. Funding the next stage of growth won’t be a problem. Working with TomTom data (the Mapquest provider in the US) will be helpful with potential clients who view the company’s reliance on OpenStreetMap with a degree of skepticism.

The Billion Dollar Question

Who gets access to Verizon’s mobile location data?

As I mentioned in my last post, “noisy” geotagged mobile data in aggregate becomes very valuable, both as behavioral as well as spatial data. Verizon already sells aggregated/anonymized customer data to 3rd parties, so giving subsidiaries and partners a taste would make sense.

With the rationale of Verizon’s purchase of AOL being “ad tech”, being able to weave in customer location behavior would be a slam dunk for Mapquest.

But will Mapbox be able to get its hands on the Verizon trove?

Good question. But Mapbox CEO Eric Gunderson understands the value of a user data feedback loop:

“Nokia HERE is just doing it wrong,” he says of how the company’s mapping division, now up for sale, constructs its dataset. “They are spending over a half a billion dollars a year driving cars around and processing that data. That was how you made a map 10 years ago — like back when you had these little Nokia dumb phones. These guys don’t understand the idea of building for mobile and building tools for developers — if they did they would be able to get real time data streams back and have a better map.

As a vocal proponent of OpenStreetMap, it’s tantalizing to think of the boost in quality to OpenStreetMap in the US should Mapbox have access Verizon data streams and be able to put derived data of higher quality back into the commons. A couple of problems with that vision are a) Verizon could rightly see those derived products as a competitive advantage to be kept in-house and b) the licensing issues around OpenStreetMap continue to be thorny.

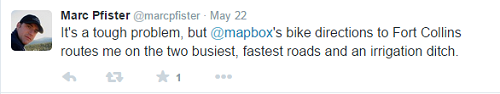

For Mapbox and others heavily on reliant on OpenStreetMap, their tech will only be as cool as the quality of data behind it. Consider Mapbox’s recently launched Bicycle Directions:

Now ponder the possibilities of enriching the directions with data streams of where people actually bike?

So, yeah, data feedback loops are critical because you don’t get a second chance after sending a user into an irrigation ditch.

* * * * * * *

Both Mapquest and Mapbox will immediately benefit from the announced collaboration. But whether the much bigger prize of Verizon’s mobile location data stream will be seized, and by who, is what’s worth keeping an eye on.

Brian Timoney is an information consultant in Denver, Colorado.